CryptoCurrency

Stablecoins: A Safe Way to Invest in Crypto

Introduction:

In the fast-paced world of cryptocurrencies, where volatility is the norm rather than the exception, finding a secure and stable investment option can be a daunting task. However, there is a solution that allows investors to navigate through the unpredictable waters of the crypto market with more confidence and peace of mind – stablecoins. These unique digital assets have gained significant popularity in recent years, attracting investors looking for a safer way to participate in the cryptocurrency space. In this article, we will explore the concept of stablecoins and how they, along with platforms, offer a safe avenue for investing in the exciting world of digital assets. To efficiently invest in crypto like Bitcoin, you may visit a trusted trading platform like https://bitqt-app.com.

What are Stablecoins?

To grasp the concept of stablecoins, one must first understand the inherent volatility of cryptocurrencies like Bitcoin and Ethereum. While these digital assets hold tremendous potential for growth, their value can fluctuate dramatically within a short period, posing considerable risks to investors. Stablecoins, on the other hand, are a subset of cryptocurrencies designed to maintain a stable value by pegging their worth to an underlying asset, such as fiat currency, commodities, or even other cryptocurrencies.

Why Are Stablecoins a Good Investment?

There are several reasons why stablecoins may be a good investment for you. First, stablecoins offer a way to invest in cryptocurrency without the risk of wild price swings. This makes them a good option for investors who are looking for a more stable investment.

Second, stablecoins can be used to store value and make payments. This makes them a good alternative to traditional fiat currencies, which can be subject to inflation and other risks.

Third, stablecoins can be used to earn interest. There are several platforms that allow you to lend your stablecoins and earn interest on them. This can be a good way to generate passive income from your crypto holdings.

The Advantages of Stablecoins

Stability Amidst Market Volatility

The primary advantage of stablecoins is their stability. Unlike traditional cryptocurrencies that can experience wild price swings, stablecoins are designed to maintain a steady value. By pegging themselves to real-world assets, stablecoins offer investors a safe haven during turbulent market conditions, reducing the risk associated with traditional crypto investments.

Instant Transactions and Lower Fees

Stablecoins enable swift and low-cost transactions, making them an ideal choice for remittances and cross-border transfers. Traditional banking systems often involve intermediaries and incur significant fees, but stablecoins provide a more efficient alternative.

Hedging against Crypto Market Volatility

Even seasoned cryptocurrency investors can feel uneasy when witnessing the extreme price fluctuations in the market. Stablecoins offer a viable hedging strategy against such volatility. During times of uncertainty or potential bearish trends, investors can convert their cryptocurrencies into stablecoins, preserving their value until market conditions improve.

Diversification of Investment Portfolios

Stablecoins offer an opportunity for investors to diversify their portfolios without entirely exiting the crypto market. By holding stablecoins alongside traditional cryptocurrencies, investors can strike a balance between potential high returns and stability, reducing overall risk exposure.

The Mechanisms Behind Stablecoins

There are different types of stablecoins, each employing distinct mechanisms to maintain their value. The three common categories are:

Fiat-Collateralized Stablecoins

These stablecoins are backed by reserves of fiat currencies, such as the US Dollar or Euro, held by a trusted custodian. For every issued stablecoin, an equivalent amount of fiat currency is held in reserve, ensuring stability and redeemability.

Crypto-Collateralized Stablecoins

These stablecoins are backed by other cryptocurrencies like Ethereum or Bitcoin, using smart contracts to maintain price stability. While they offer greater decentralization, the value of these stablecoins is still influenced by the volatility of the underlying crypto assets.

Algorithmic Stablecoins

Algorithmic stablecoins rely on smart contracts and algorithms to adjust their supply dynamically. When demand increases, new stablecoins are minted, and when demand decreases, stablecoins are burned, regulating the price to remain stable.

Conclusion

Stablecoins present a compelling proposition for investors seeking a safer way to enter the world of cryptocurrencies. With their ability to provide stability amidst a highly volatile market, these digital assets offer a secure avenue for investing and diversifying portfolios. By collaborating with platforms, investors can leverage the advantages of stablecoins while benefiting from a user-friendly and secure online trading experience. As the crypto market continues to evolve, stablecoins are poised to play an increasingly significant role in the financial landscape, bridging the gap between traditional finance and the exciting realm of digital currencies.

CryptoCurrency

Risks and Rewards: A Comprehensive Analysis of Cryptocurrency Swaps

Cryptocurrency swaps have become a popular method of investing in cryptocurrency. They’re easier to understand than many other ways of investing in crypto, and they can be a good way to diversify your portfolio by adding exposure to different types of digital assets or asset classes. However, there are some risks involved with these transactions that you should be aware of before deciding whether or not one makes sense for you.

Understanding Impermanent Loss

In this section, we’ll look at the risks and rewards of cryptocurrency swaps. First, let’s define what a swap is. A swap is an agreement between two parties to trade one asset for another at an agreed-upon price on a specific date in the future. In other words, if you want to swap usdc to ftm but don’t have enough money, you can make a deal with someone who has enough cash on hand – and then pay them back later with interest or additional cryptocurrency (depending on how much risk each party wants). This type of arrangement has many applications in both traditional finance and cryptocurrency trading because it allows individuals to take advantage of their unique situations: You might not be able to trade immediately due to a lack of funds; someone else may be willing to provide liquidity until yours comes through; meanwhile, both parties benefit from higher prices while they wait for their transactions go through.*

Cryptocurrency Swaps vs Futures Contracts & Spot Trades* What makes swaps different? Unlike futures contracts where buyers lock in prices several months before expiration dates; these trades are executed immediately upon execution so there’s no need for collateralization or margin requirements.* How Can You Mitigate Risks? Swaps allow traders access to valuable information about current market conditions without having any capital tied up during negotiations – so long as both parties agree on terms beforehand!

Security Concerns in Decentralized Trading

In a decentralized trading environment, the security of your funds is your responsibility. You are responsible for protecting them from loss and theft by taking appropriate steps to ensure that they remain safe in their wallet.

While there are no guarantees that any given exchange, wallet, or other service will not be hacked at some point in time, there are many measures you can take to mitigate risk:

- Use two-factor authentication (2FA) whenever possible on exchanges and wallets that support it; this includes Google Authenticator or Authy apps as well as hardware key fobs such as Yubikeys or Trezors. Some exchanges offer 2FA via SMS text messages which may not be as secure as other options due to potential vulnerabilities associated with SMS delivery systems but even if an attacker were able to intercept these messages then they would still need access codes sent via email/SMS before being able to withdraw funds from your account; so this should only apply if you’re using a separate phone number for verification purposes anyway!

- Always keep backups of private keys securely stored offline (e.g., encrypted files on an external hard drive which is then kept somewhere safe). You can also write down private keys on paper but remember: If anyone else sees them then they’ll also be able to see how much money we have! So don’t give these away unless necessary and never email them unless necessary.”

Rewards of Liquidity Provision

Providing liquidity to the market is a risky business. If you’re going to do it, you need to ensure that your risks are well-balanced with rewards. In this section, we’ll look at some of the benefits and drawbacks of providing liquidity in cryptocurrency swaps.

First, what exactly does “liquidity provision” mean? It means selling coins when the price is high and then buying them back when the price is low – all within a short period (usually minutes). This allows traders who want to buy or sell quickly but don’t have enough funds on the exchange at any given time – or even those who just want more flexibility in managing their investments – to trade and exchange busd to avax profitably without having to wait for buyers or sellers around them who may never show up!

This practice can be very profitable for those who manage their positions well enough; however, there are also significant risks involved since these trades often involve moving large amounts of money around quickly across multiple exchanges without having much control over where prices might go before hitting either endpoint during those transactions’ lifetimes (which might be just seconds long).

Balancing Risk and Reward: A User’s Guide

In the dynamic realm of cryptocurrency swaps, users must navigate a delicate balance between risk and reward to optimize their trading experience. An effective strategy involves a thorough understanding of impermanent loss, slippage, and security considerations inherent in decentralized trading. Mitigating these risks can be achieved through prudent risk management practices, such as diversifying assets, setting realistic profit goals, and staying informed about market trends. Users are encouraged to leverage liquidity provision opportunities but should do so cautiously, considering factors like token volatility and market liquidity. The key lies in adopting a well-informed approach, where users are not only aware of the potential rewards, such as yield farming incentives but also equipped with strategies to minimize risks. By staying attuned to the evolving landscape, users can strike a harmonious balance between risk and reward, enhancing their overall experience in the world of cryptocurrency swaps.

Conclusion

With the benefits of liquidity provision and its risks in mind, we hope you’re better equipped to decide on whether or not to participate in cryptocurrency swaps. As we mentioned earlier, it’s important not to get carried away with hype and speculation but at the same time don’t be afraid of exploring new opportunities when they come along!

CryptoCurrency

Online Payments: Exploring the Trends & Boundaries

In recent years, the online betting landscape has seen a transformative shift, not just in terms of game options and platforms but also in the ways users transact funds. With technology advancing at a staggering pace, online payments in betting have expanded and diversified, embracing the new whilst reinforcing the old. As this comprehensive coverage of payment methods for betting suggests, the horizon is wide, but what are the specific details lying at the centre of all this?

Digital Wallets: A Leap Towards Frictionless Transactions

E-wallets, or digital wallets, have rapidly taken centre stage in online payment solutions, especially in the betting domain. Their charm lies in the blend of speed, convenience, and security they offer. In an age where immediacy is paramount, the ability to make quick deposits and withdrawals using e-wallets is a significant benefit for bettors.

There are several reasons behind their rise:

- Speed: E-wallet transactions are instant. Funds can be transferred in real time, allowing for instantaneous betting, a feature particularly useful for in-play fans.

- Security: They offer an extra layer of protection, acting as a buffer between the user’s bank and the betting platform. This ensures that personal financial details remain undisclosed.

- Convenience: They eliminate the need for entering card details multiple times, ensuring a smoother user experience.

Platforms like PayPal, Neteller, and Skrill are leading the charge, continually innovating to offer their users a seamless experience.

Cryptocurrency Adoption: Betting on the Digital Frontier

Once a niche and mysterious domain, cryptocurrencies are steadily strengthening their place in the mainstream, and the betting world has not remained untouched. Cryptocurrencies, led by the charge of Bitcoin, offer several features attractive to the betting community:

- Anonymity: Transactions are recorded on a blockchain without revealing users’ personal details, ensuring complete discretion.

- Lower Fees: Most cryptocurrency transactions have reduced fees compared to traditional payment methods, a prospect appealing to high-stake bettors.

- Universal: Cryptocurrencies operate on a global scale, devoid of regional or national boundaries, making them suitable for international gambling platforms.

However, their volatile nature and regulatory ambiguities present challenges, which leads us to our next point.

Payment Regulations: Striking the Balance

Online payments, despite their numerous advantages, exist in a world rife with challenges, predominantly stemming from regulatory hurdles. Different jurisdictions have distinct stances on online betting, impacting the payment methods allowed:

- Licensing: Many countries require betting platforms to possess specific licenses if they wish to offer services to their residents.

- Limitations on E-wallets: Some jurisdictions disallow the use of e-wallets for betting transactions, necessitating platforms to diversify their payment portfolios.

- Cryptocurrency Clampdown: Certain nations are sceptical about the unregulated nature of cryptocurrencies and, as such, limit or even prohibit their use in betting.

The regulatory environment, while ensuring safety, often requires bettors and platforms to remain agile and informed, adapting to the ever-evolving online gambling environment.

Navigating the Dynamic World of Online Payments

In the elaborate relationship of technology and finance, online payments in betting have emerged as a fascinating space. From the seamless immediacy of digital wallets to the disruptive potential of cryptocurrencies, the spectrum is vast. But with great innovation comes the responsibility of regulation, creating an ecosystem where adaptability is key. As the boundaries of online payments continue to expand, one thing remains clear: the world of betting is on the cusp of a financial revolution, and the journey ahead promises to be entertaining and full of simple, straightforward transactions.

CryptoCurrency

Godex – Anonymous Cryptocurrency Exchange Like A Professional

Anonymous Cryptocurrency exchangers are very popular with users of digital money networks. This is due to the fact that not everywhere you can pay with bitcoin, ether or other crypto coins, however, you can buy any product or service for them, having previously exchanged for fiat (traditional money). In this article we will tell you about the peculiarities of working with exchangers.

An exchanger is a specialized service that provides services for the exchange of funds from various payment systems (including digital currencies in all directions). Each service charges a commission for its services and exposes its own cryptocurrency rates (based on exchange) for the exchange.

The ability to conduct transactions with cryptocurrencies anonymously is one of their main advantages. In a anonymous cryptocurrency exchanger, you can exchange digital currencies without specifying your personal data.

But it looks like users will soon lose this advantage. Regulators are launching an assault on cryptocurrency exchanges and exchanges, demanding that they disclose information about their customers. In this regard, what should the owners of cryptocurrency expect in the future? We will tell you about this today and what is the most profitable anonymous cryptocurrency exchange Godex .

Godex is a multi-chain anonymous cryptocurrency exchange launched in Q2 2018 that allows users to exchange cryptocurrencies at a fixed exchange rate. Godex is the exchange of choice for those who value privacy and speed of exchange.

Over 200 tokens on an anonymous exchange

Today, the anonymous cryptocurrency exchange market segment is saturated with well thought out and powerful products. Even so, Godex still significantly outperforms most of its competitors in the types of blockchains and assets available on exchanges.

It supports cryptocurrency giants like Bitcoin (BTC) and Ethereum (ETH). Competitors’ own assets such as BNB and Crypto. com (MCO). The total number of tokens supported by Godex exceeds 200 positions.

Godex does not use orders: all transactions are carried out at a fixed cryptocurrency exchange rate. This feature is especially useful for those new to cryptocurrency who may find common betting systems and be confusing on most exchanges.

Additional opportunities for legal entities and individuals

From day one, the Godex team proudly announced that their trading volume is unlimited. After registration, the user can exchange any amount of cryptocurrency they wish.

The main advantages include:

- stable improvement of the reputation and prospects of electronic currencies – most experts agree that in a couple of years virtual money will be used on a par with fiat currencies, and the value of the most popular types of crypt will increase significantly (and there is a likelihood of periods of “stagnation”);

- independence of the course from most external factors, including political and military events;

- availability of financial transactions – most large online stores and companies (and even government agencies in some countries) accept payments in coins. Any user can exchange cryptocurrency online using the services of Godex anonymous cryptocurrency exchange.

-

Apps5 years ago

Apps5 years agoHow to Book an Ola or Uber Using Google Maps

-

Internet5 years ago

Internet5 years agoHow to Download a Copy of Your Aadhaar Card

-

Sports3 years ago

10Cric India Bookmaker Review for Betting on Sports Online in 2022

-

Apps5 years ago

Apps5 years agoHow to Install WhatsApp Beta for Windows Mobile or Windows Phone

-

Android Games5 years ago

LDPlayer vs Nox Player: Powerful Android Emulator for Gaming

-

How to5 years ago

How to5 years agoJio Fiber Landline Service: How to Activate Jio Home Phone aka JioFixedVoice for Free Calling

-

How to5 years ago

How to5 years agoHow to Increase Followers on Instagram for Real

-

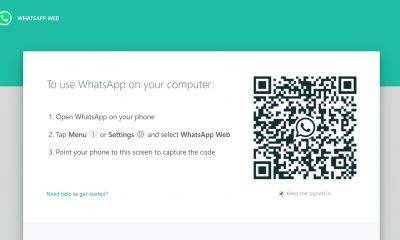

How to5 years ago

How to5 years agoWhatsApp Web: Everything You Need to Know